What is a Health Savings Account (HSA)?

A Health Savings Account (HSA) is a savings account that earns interest and you have the funds you put into it for life. You generally set up an HSA as part of your employer benefits. But you can also open one outside of an employer program.

An HSA is a tax-advantaged savings account that you can use to pay qualified medical expenses that your health plan (insurance) doesn’t cover. Similar to an employer-sponsored retirement plan, HSAs are owned and funded by the employee, and employers may also contribute to the HSA. The IRS requires you to choose a High Deductible Health Plan (HDHP) in order have an HSA, which typically has lower upfront premiums (vs. Low-deductible PPO/POS plans or HMO’s), but higher deductibles as you start to make medical claims.

With an HSA, you specify how much PRETAX income to contribute from each paycheck (up to annual limits set by the IRS). When you withdraw from your HSA to pay for qualified medical expenses, you may take it out TAX FREE. The funds in your HSA may remain as cash savings or you may invest all or some of them, depending on your plan rules—and most HSAs have a minimum cash requirement before allowing money to be invested. The interest or investment gains your money earns is TAX FREE. Contributions can be made up to age 65 and are eligible for Medicare. Unlike annual Flexible Spending Accounts (FSA’s) in which funds unspent are forfeited, HSA funds are yours for life even if you change jobs, switch plans, or retire.

HSA’s are the only long-term savings vehicles available with a TRIPLE TAX ADVANTAGE:

• The money goes in before you pay tax (or are tax deductible)

• Any interest you earn in the account is never taxed

• The money, if used for eligible medical expenses is not taxed when you withdraw the funds

These benefits are even more generous than 401k’s and tax-deductible IRA’s as the money is never taxed (again, if used for qualified medical expenses)

Best Ways to Use Your HSA Funds

With some simple forward planning, using your HSA funds can be very beneficial financially for most people/families.

• Do you worry about having to pay deductibles and co-pay from your budgeted monthly cash flow?

• Are you holding back getting the health care and mental health services you need because of the cash flow you your household budget?

• What if you had a little extra saving set aside to cover these expenses and that money is tax free?

HSA’s are set up to help you manage these issues!

Your Health Savings Account can be used to pay for your deductibles and co-pays without burdening your regular, budgeted monthly cash flow. Yes, you will need to develop a budget that allows you to save your pre-tax dollars, which will lower your normal “take home” pay, but it lowers it by much less than having to come up with after tax dollars to pay for an emergency health care expenses, or ongoing therapy and doctors’ appointments.

How Much Can I Really Save?

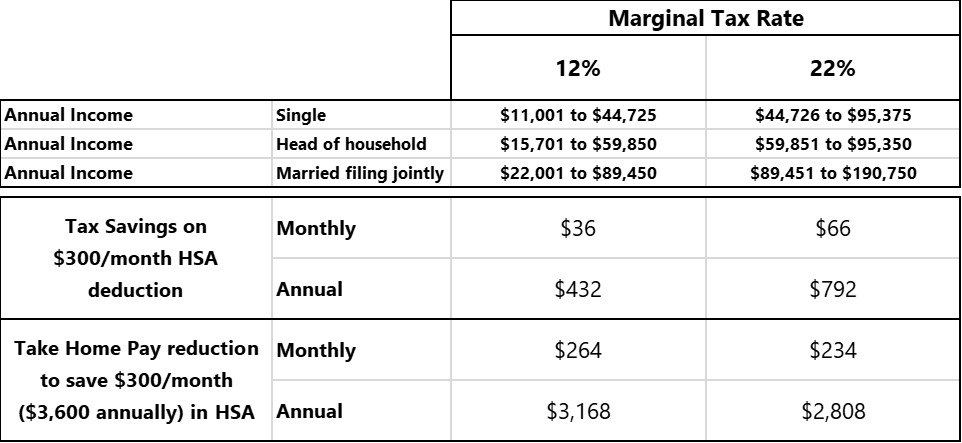

The easiest way to explain the savings is to provide a simple example. With that, let’s start with some assumptions.

If you have a $3,600 deductible and are in the 22% marginal tax bracket (above $45K household income for single and above $90K household income for married filing jointly), you would have to earn over $4,600 to pay that deductible if using after tax dollars! If your family deductible is $7,000, you would have to earn almost $9,000 to cover that!

Even if you are lower income and in the 12% tax bracket ($11K-$44K single and $22K-$90 for married filing jointly) your $3,600 would cost you around $4,100 pre-tax earnings, and with the $7,000 family deductible, you would have to work enough to cover almost $8,000 before tax.

These savings are significant to most people, and again, just a little forward planning, and short term pain of getting used to a slightly smaller paycheck, will payoff quite quickly.

To look at it from the other side… How much would my paycheck have to go down per month to save the $3,600?

Let’s say you wanted to save $300/month into your HSA ($3,600 annually), in the 22% marginal tax bracket, your monthly take home would drop by $234. In the 12% marginal tax bracket, your monthly take home would drop by $264.

Obviously, this is something that may take some time to get used to and certainly some re-budgeting may be required, but again, the long term benefits as you build your health savings likely far outweigh the short-term pain of having to reprioritize your household spending.

Here is a chart that might help make it easier to see:

Other MAJOR Considerations – IMPORTANT!

Many employers who offer HSA’s also provide “seed money” each year into your account. That is FREE MONEY and is yours to keep for life – or spend it on healthcare costs.

Also note that if your employer deducts a health care premium from your pay, and offers choices for health care that include Lower Deductible PPO and POS plans, or HMO plans, the costs for you to choose those plans (again, if your employer charges you for some portion for your health insurance) is usually higher than what you are charged for a high-deductible plan with an HSA, so the savings there should also be included in your monthly budget. For many company health plans, these savings are significant and must be evaluated when you are calculating your budget. You may actually not notice any difference in your take home paycheck, even after contributing to the HSA account.

How Much Can I Contribute Each Year?

The HSA contribution limits for 2024 are $4,150 for self-only coverage and $8,300 for family coverage. Those 55 and older can contribute an additional $1,000 as a catch-up contribution. These limits INCLUDE any funds that your company may contribute to our account.

Summary

Now is the time!! Build wealth for your future, reduce your household’s pain of ever-increasing healthcare costs, and seriously consider adding an HSA to your overall budget. If you have questions or world like to discuss, talk to your tax professional or accountant if you have one, or reach out to us at Heart and Mind Counseling at admin@heartandmindcounseling.com and we will get back to you.

More About Heart and Mind Counseling

Heart and Mind Counseling is a full-service Telehealth Psychotherapy service helping clients with a broad spectrum of needs in Michigan, Alabama, Colorado, Georgia, Florida, Iowa, Kansas, Massachusetts, New Jersey, Ohio, Pennsylvania, Texas, Vermont and Wisconsin.

Dr. Corinne Smorra, LCSW is trained in EMDR and specializes in therapy for patients and families dealing with congenital heart issues, chronic disease, anxiety, depression, organ transplant, end of life, and grief. For more about Dr. Smorra and her research, please visit https://www.linkedin.com/in/dr-corinne-smorra-dsw-msw.lcsw-439a9ba/ or www.heartandmindcounseling.com.

Katie Dines, LCSW is trained in EMDR and specializes in self-esteem, depression, anxiety, substance abuse, inner conflict, relationship issues (domestic abuse, negative relationship patterns). Katie is licensed in Michigan

Kennedy Boulis, LCSW is trained in DBT, does crisis counseling as well as specializing in eating disorders, ADHD, adoption, children, adolescent, family, and adult clients. Kennedy is licensed in Michigan

Lauren Thomas, LCSW is a trauma therapist Certified in Trauma Focused CBT and CPT. She specializes in trauma, chronic disease and pain, anxiety, depression, anger management, grief, pregnancy and child loss. Lauren is licensed in Michigan and Florida.

Brandy Goins, Phd (ABD), LPC certified in DBT, is a Licensed Sex Offender Treatment provider specializing in domestic, sexual abuse, addiction, and trauma. She also specializes in a range of mental diagnoses such as schizophrenia, schizoaffective disorder, bipolar disorder, dissociative identity disorder. Ms. Goins also specializes in polyamorous, kink, LGTBQ+, transgender populations as well. Brandy is licensed in Michigan and Texas.